Research approach: survey

Analytical method: quantitative and qualitative

Millennials and the Future of Banking (Spataro.2015) explore the behaviors and attitudes millennials have towards banks and banking, examine their financial needs, based on this research, and defines an image of the future of banking.

During the week of September 20, 2015, the online survey was sent out to millennials across the United States, to study their banking habits and behaviors of millennials, and to gather insights on their future needs and desires from banking. The study unveils insights that help banks understand the banking behaviors of millennials so that banks may prepare for the future.

We received 450 completed surveys from people in 46 US states, who are 18 years old – 35 years old. They answered questions about their banking behaviors, habits, and attitudes, and provide their point of view on the bank of the future.

The survey was structured for qualitative and quantitative analysis and codified 123,726 data points. In the full study, we discuss:

- Observations on the behaviors and attitudes millennials have towards banks and banking

- Examination of their financial needs

- Millennials’ reflections and opinions on the future of banking

The data gathered from the surveys provide insights, observations, and conclusions on the millennials’ attitudes and behaviors towards banking. The millennial respondents then reflect on their perception of the future of banking. These intelligent users of digital technology give a surprising perspective of what the bank of the future will become for their use.

Millennials are still using banks! 90% use some banking products, 59% have a bank account, and 47% use an actual checkbook. These are just some of the behavioral data points unveiled in the report, with several other insights that offer banks an understanding of millennials, their values, and needs for the present and future. Here is an excerpt from the study:

Millennials Have No Shortage of Words When Asked to Express Their Opinions About the Bank Of 2035. Their Opinions Foreshadow the Future of Banking.

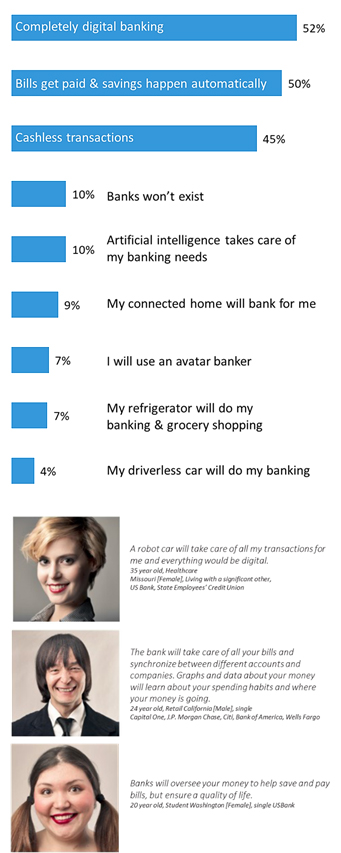

More than half (52%) of the millennials want a completely digital banking experience. They (50%) don’t want to struggle or waste time managing their accounts and budgets. They want their bills to get paid and savings to automatically happen, whereas previous generations spent hours balancing a checkbook to ensure there was the money available to pay bills.

Millennials (45%) believe that in the future transactions will be cashless. They are redefining the term “banking” to have a personal meaning. Most realize that the act of banking will exist, whether online or mobile, while some (5%) believe the physical bank may go away.

Some millennials (10%) believe the future of banking is through artificial intelligence that will take care of their banking needs. Millennials already use voice assistance either from Siri, Google Now, Cortana, and Amazon’s Alexa, which will appeal to the 7% that believe their banker has an avatar and will engage them in a virtual world.

Others believe the bank will go beyond the mobile and online confines; 10 % of millennials want their home connected to the bank, including the refrigerator, which does their banking and grocery shopping. They want to command their driverless cars to go to the bank or other places to make transactions, and in addition to picking up their groceries or whatever they desire

Three Key Themes

|

Millennials (4%) expressed a need for human contact, a desire to use more cash, and wanting to do their banking. These millennials are also not interested in automated options, nor having their kitchen appliances do their banking.